Car Insurance Requirements in Saudi Arabia

In Saudi Arabia, having car insurance is not just a recommendation but a legal requirement for all vehicle owners. This crucial step ensures protection for both your property and the safety of others on public roads. To meet insurance standards effectively, providers outline specific conditions that drivers must adhere to. Saudi law mandates that all car owners must obtain third-party liability insurance, which covers damages and injuries caused to others in the event of an accident.

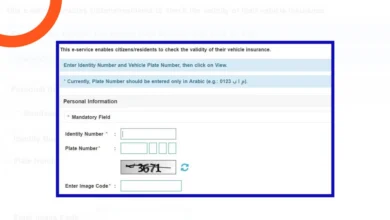

Car Insurance Renewal Requirements in Saudi Arabia

- Ensure that all required fees for the renewal process are paid.

- Settle any outstanding traffic violations linked to the vehicle.

- The car must have a valid periodic inspection certificate. If it has expired, renew it before applying for insurance renewal.

- The existing car insurance policy must still be valid at the time of renewal.

Third-Party Car Insurance Requirements in Saudi Arabia

- The insurance policy must be active and valid at the time of an accident to provide coverage.

- The policyholder must pay the insurance premiums on time to maintain coverage.

- Incidents that are not due to natural events like floods or heavy rain are typically covered.

- To obtain or renew insurance, drivers must ensure their license is up to date and valid.

- Insurance coverage may not extend to accidents occurring outside the borders of Saudi Arabia.

- Insurance companies offer discounts between 10% to 40% for drivers who maintain a long record without traffic violations, provided they follow all traffic laws.

Car Insurance Exclusions in Saudi Arabia

When it comes to car insurance in Saudi Arabia, there are specific situations where coverage is not provided. These exclusions apply to both comprehensive and third-party insurance policies:

- Damage resulting from poor maintenance or misuse of the vehicle is not covered.

- Any damages incurred while participating in racing events or drifting are excluded.

- Insurance does not cover damages if the driver is under the influence of alcohol or drugs.

- Accidents involving unlicensed drivers will not be covered by the insurance policy.

- Coverage does not extend to incidents that occur outside the borders of Saudi Arabia.

In addition to the general exclusions, car insurance policies in Saudi Arabia may include specific additional exceptions:

- Damages caused by natural events, such as floods or earthquakes.

- Damages resulting from fire or theft.

- Damages resulting from contact with chemicals or other hazardous substances.

Note: It is crucial to thoroughly read your car insurance policy to fully understand the exclusions that may apply.

Tips to Avoid Car Accidents and Increase Insurance Coverage

Here are some tips to avoid car accidents and increase the insurance coverage for damages:

- Drive responsibly at all times.

- Conduct regular maintenance on your vehicle.

- Avoid driving under the influence of alcohol or drugs.

- Allow only licensed drivers to drive your car.

- Don’t drive your car outside Saudi Arabia’s borders.

By following these tips, you can better protect yourself and your vehicle while maximizing the benefits of your insurance coverage.